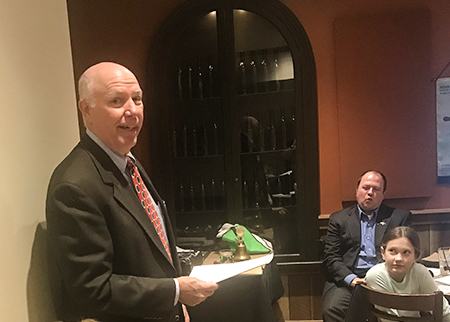

Every year Bob Drew gets us fired up about taxes. He did it again last week!

CPA Bob Drew reviewed the Tax Cut and Jobs Act, estate planning and current tax issues in a talk with the Hudson Clocktower Rotary on March 4.

CPA Bob Drew reviewed the Tax Cut and Jobs Act, estate planning and current tax issues in a talk with the Hudson Clocktower Rotary on March 4.Bob talked about the election cycle and tax law. All of the House and one-third of the Senate and the White House are up for election this Fall. No meaningful tax legislation happens in even years with an election coming. But in odd years, especially after a change in the White House, we expect new rules.

If the Democrats sweep Congress and the White House in November, next winter will be interesting for tax law. Bob believes Trump will remain in office and the Republicans will maintain control of the Senate.

Trump's tax law took effect January 1, 2018. This filing season we are just starting to see returns after people saw the changes last year with the new rules. Significant changes occurred to both individual and business taxes, but in the interest of time, Bob kept his remarks mainly to individuals.

Bob pointed out that the standard deduction was increased. Some miscellaneous deductions were eliminated. State, city and real estate taxes were limited to $10,000 and medical deductions went back to 7.5 percent of the adjusted gross income.

The net result? Fewer people will itemize and more will take advantage of the larger standard deduction.

Thanks, Bob, for helping all of us stay out of jail for one more year!